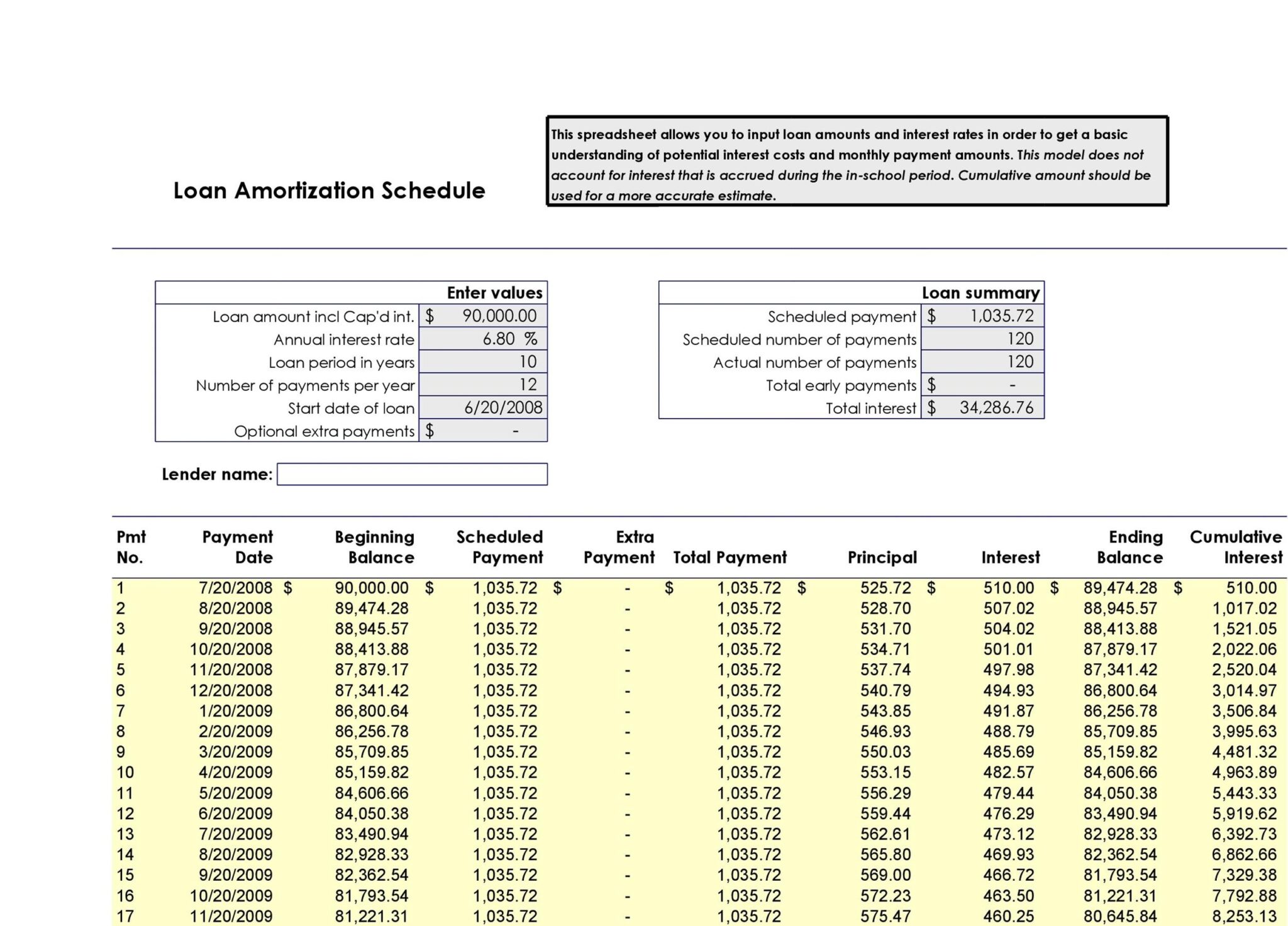

This Business Analytics certification course course teaches you the basic concepts of data analysis and statistics to help data-driven decision making. The table is very useful in calculating the regular payments.īoost your analytics career with powerful new Microsoft Excel skills by taking the Business Analytics with Excel course, which includes Power BI training In this article, we made the amortization loan schedule table and understood how the different functions work. To find the balance after the first payment in cell E8, you will need to add up/combine the loan amount (C5) and the principal of the first period (D8).īecause a loan amount is a positive number and the principal is a negative number, the principal is subtracted from the loan amount.įor the second and all periods succeeding this, you can add up the previous balance and the first period's principal to get the required result. This is another example that money grows over time.There are two different formulas to calculate the remaining balance. The PMT function below calculates the monthly withdrawal.Įxplanation: you need a one-time payment of $83,748.46 (negative) to pay this annuity. How much money can you withdraw at the end of each month for the next 20 years?ĥ.

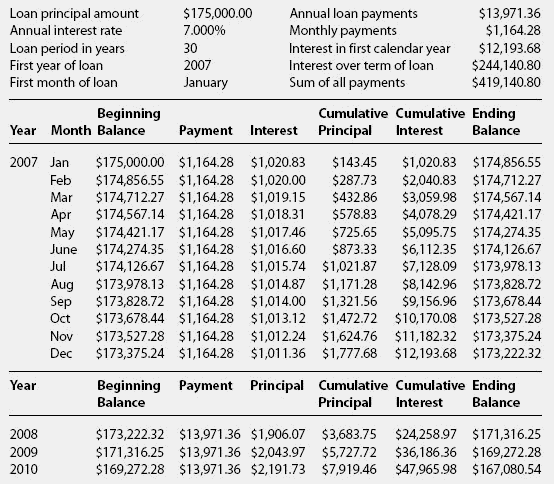

The higher the interest, the faster your money grows.Ĭonsider an annuity with an annual interest rate of 6% and a present value of $83,748.46 (purchase value). The PMT function below calculates the annual deposit.Įxplanation: in 10 years time, you pay 10 * $100 (negative) = $1000, and you'll receive $1,448.66 (positive) after 10 years. How much money should you deposit at the end of each year to have $1,448.66 in the account in 10 years?Ĥ. Note: we make monthly payments, so we use 6%/12 = 0.5% for Rate and 20*12 = 240 for Nper (total number of periods).Ĭonsider an investment with an annual interest rate of 8% and a present value of 0. The PMT function below calculates the monthly payment. Note: we make quarterly payments, so we use 6%/4 = 1.5% for Rate and 20*4 = 80 for Nper (total number of periods).ģ. The PMT function below calculates the quarterly payment. We pay off a loan of $150,000 (positive, we received that amount) and we make annual payments of $13,077.68 (negative, we pay).Ģ.

Note: if the fifth argument is omitted, it is assumed that payments are due at the end of the period.

0 kommentar(er)

0 kommentar(er)